So what’s the difference in taxes between medical and recreational marijuana? Across the country, cannabis is becoming legal, but there still may be some benefits for having a medical card. Let’s break it down.

Which states tax marijuana?

First off, let’s talk taxes. What do we pay normally, and what how does it change when purchasing marijuana? According to Leafly, some states tax marijuana at a rate of 20-30% — much higher than even alcohol or cigarettes. Here’s how it breaks down:

An excise tax is imposed on specific goods like tobacco, beer or, marijuana. In politics, these taxes are often called “sin taxes,” because they added on top of other traditional taxes. When it comes to marijuana, the consumer has to cover the excise tax.

Sales tax is a common line on most receipts. Marijuana sales are no exception.

Local taxes are special taxes to fund specific programs in local areas. Some states will include a local tax on marijuana products.

Alaska, California, Massachusetts, New York, Oregon, and Virginia allow localities to levy an additional tax on marijuana purchases. For example, in California some marijuana purchases are subject to excise taxes, sales tax and local business taxes ranging between 1%-15%.

Unless you’re in Alaska, Delaware, Montana, New Hampshire or Oregon, sales taxes are paid to states for all retail goods and services.

State by State

- Arizona: Purchases are subject to a state excise tax of 6.6% as well as an optional tax set by local municipalities of 2-3%.

- Arkansas: Purchases are subject to the 6.5% statewide sales tax and an additional privilege tax of 4%, as well as all applicable local taxes.

- California: Medical marijuana purchases are not subjected to sales tax, but are subject to a 15% cannabis excise tax as well as local taxes, where applicable.

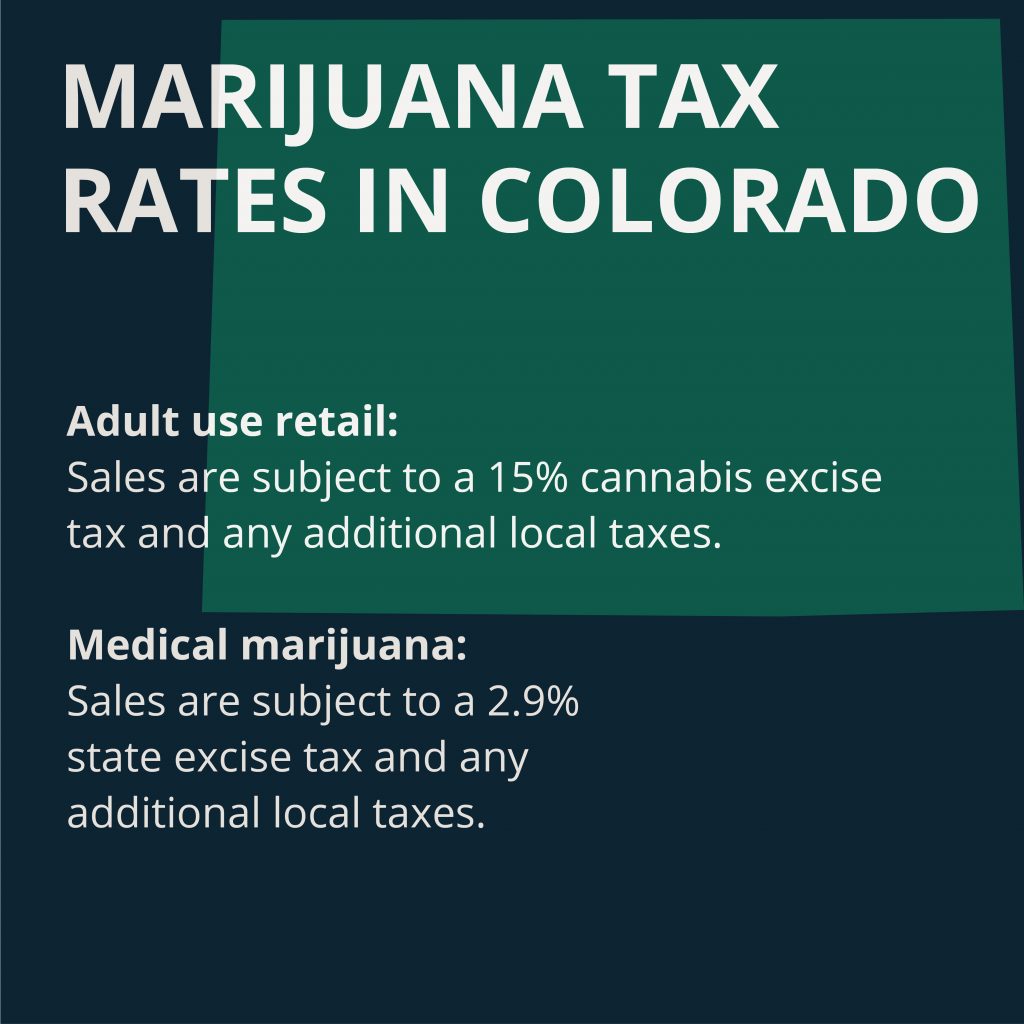

- Colorado: Sales are subject to a 2.9% state excise tax and any additional local taxes.

- Connecticut: Purchases are only subject to the statewide retail sales tax of 6.35%.

- Florida: Purchases are subject to the statewide retail sales tax of 6%.

- Hawaii: Purchases are subject to the statewide retail sales tax of 4%, except on Oahu where the tax rate is 4.5%.

- Illinois: Purchases are subject only to the 1% statewide sales tax on qualifying drugs. Sellers and cultivators also must pay a 7% tax.

- Iowa: Purchases are subject to the statewide retail sales tax of 6% and any additional local taxes.

- Maine: Purchases are subject to a 5.5% statewide sales tax. Edibles are the exception though, which are taxed at 8%.

- Michigan: Purchases are subject only to the statewide 6% sales tax.

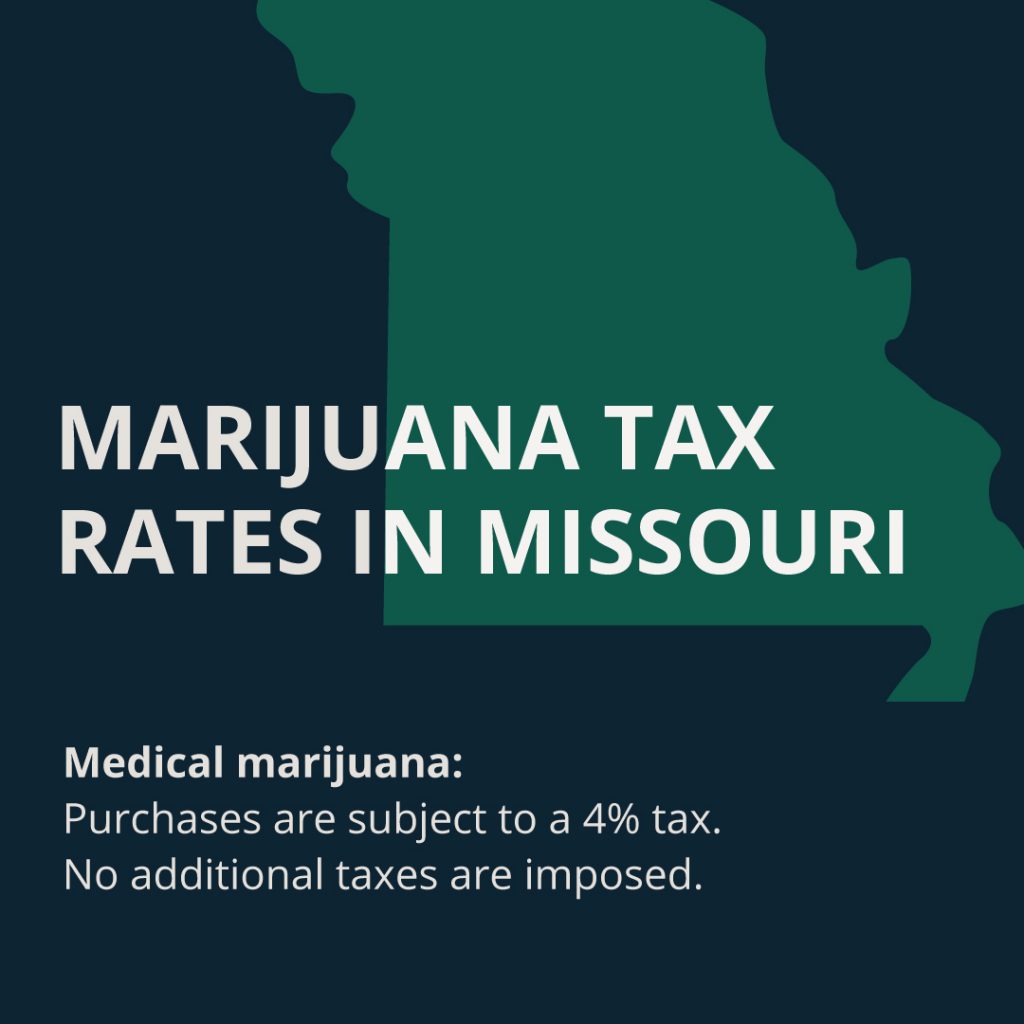

- Missouri: Purchases are subject to a 4% tax.

- Montana: Purchases are subject to a 4% excise tax.

- Nevada: Purchases are subject only to the 4.6% statewide sales tax.

- New Jersey: New Jersey currently taxes medical marijuana at 2%, but is in the process of slowly lowering taxes until they reach 0% on July 1, 2022.

- New York: Purchases are subject to a 7% medical marijuana excise tax, but are not subject to any statewide retail sales tax.

- North Dakota: Purchases are subject to North Dakota’s 5% statewide sales tax.

- Ohio: Purchasers pay statewide sales tax, which varies between 6.5% and 7.25% by county.

- Oklahoma: Purchases are subject to a statewide sales tax of 4.5%, any applicable local municipal taxes and a medical marijuana excise tax of 7%.

- Rhode Island: Purchases are subject only to the 7% statewide sales tax.

- Washington, D.C.: Purchases are subject to a sales tax of 5.75%.

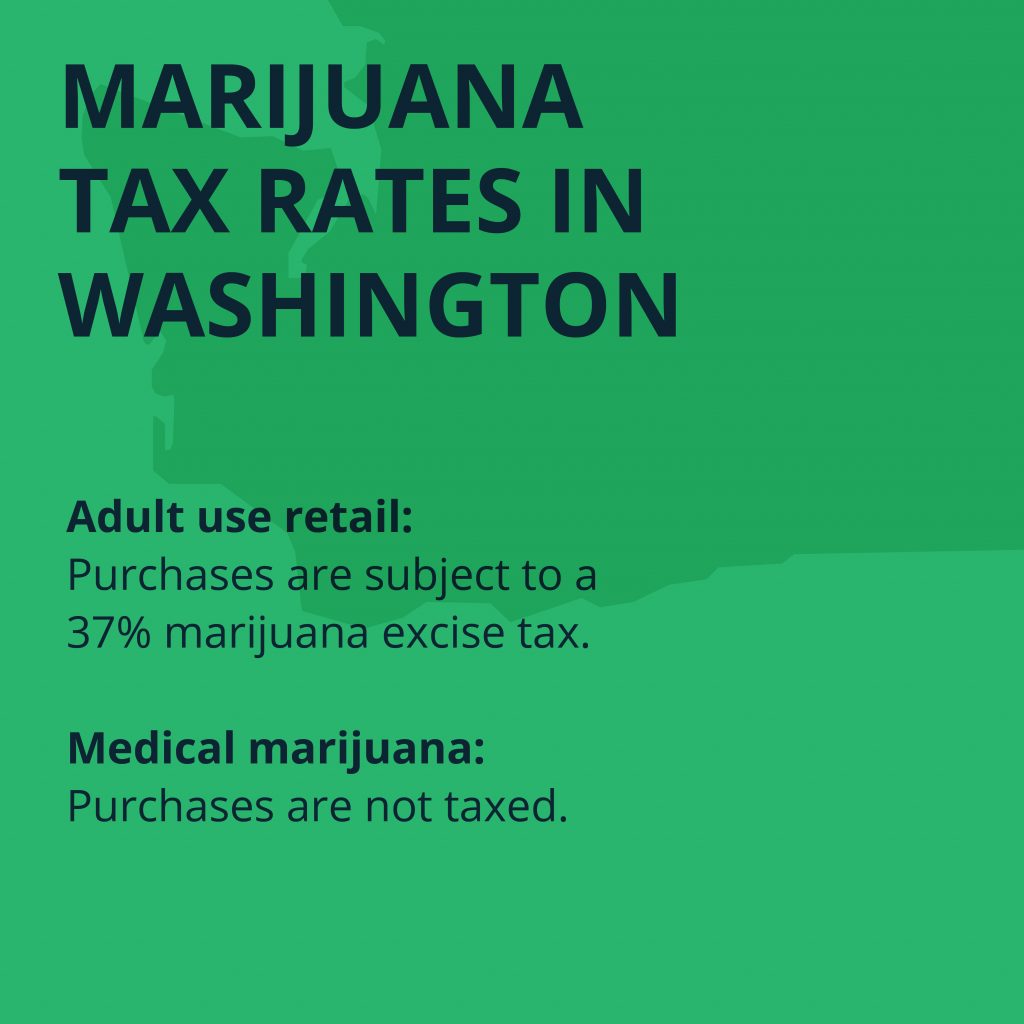

The following states do not tax medical marijuana at all:

- Alaska

- Delaware

- Louisiana

- Maryland

- Massachusetts

- Minnesota

- New Hampshire

- Oregon

- Pennsylvania

- Utah

- Vermont

- Washington

What are marijuana taxes in Missouri?

Currently, Missourians are subject for a 4% tax. Learn more on the Missouri Department of Revenue website. But changes are on the horizon as the state moves to consider recreational marijuana. Rep. Ron Hick’s (R) Cannabis Freedom Act is moving forward. According to the plan, the state Department of Revenue would set a tax rate for adult-use marijuana sales that could not exceed 12 percent, but with no tax on medical cannabis products. Tax dollars from the recreational market would be deposited into a “Cannabis Freedom Fund.”

First, taxes collected will cover the administrative costs of putting the new marijuana program into place. Remaining revenue would be divided equally between teachers’ salaries, first responders’ pensions, and the Missouri veterans commission. Licensed marijuana businesses would also be able to make tax deductions with the state up to the amount that they’d otherwise be eligible for under federal law if they were operating in a federally legal industry.

No matter where you stand, taxes in Missouri are certain to change. If the Cannabis Freedom Act passes, it will be much more affordable to be a medical marijuana patient in Missouri. Stay tuned to the greenpass blog to find out more.

What are the benefits of medical marijuana?

The use of cannabis as medicine has increased in the last decade. Proponents of medical cannabis see it as an important harm reduction strategy, and argue that it can function as a qualified substitute for prescription drugs, particularly opioids.

Now, in addition to the holistic benefits of medical marijuana, being a patient could also save you money. Learn more about how greenpass can help you become a medical cannabis patient in Missouri.

One Response